Kelly K. Deeds

Kelly K. Deeds serves as the company’s Chief Executive Officer and Audit Director. She has been with PAS since 2013 and manages client relationships, marketing, and oversees all reviews.

Kelly has over 25 years of progressive experience in finance and commercial banking with several regional and community banks in Northern California. She has been a Commercial Underwriter, Commercial Loan officer, Credit Administration Officer, Special Assets Officer, and a Chief Credit Officer. Areas of expertise include commercial lending, real estate, winery and vineyard lending, special asset/problem credit resolution, loan participations, loan policies and procedures, concentration management, and ALLL/ACL analysis. Kelly has worked with the Board of Directors and management of troubled financial institutions to successfully turn around problem loan portfolios and improve credit administration practices. She has been awarded both a bachelor’s degree in Business Administration, with a concentration in Risk Management and Insurance, and a master’s degree in Business Administration, with a concentration in Finance from California State University, Sacramento.

Janice Muncer

Janice Muncer serves as the company’s Chief Operating Officer and Audit Director. She has been with PAS since 2015 and manages company operations, including pre-audit set up, creation of pull lists, managing post audit follow-up and co-leading credit reviews.

Janice has over 30 years of commercial banking experience with regional community banks in Northern California. Her knowledge ranges from Note Department documentation and loan servicing to Credit Administration and underwriting for all areas of commercial lending. In addition, Janice has experience with identifying credits for revised risk grading based on a variety of metrics, completing problem loan reports with accurate action plans, and insuring that annual real estate reviews properly identified risk in the real estate portfolio. Additionally, Janice has overseen implementation and ongoing management of a variety of loan portfolio imaging systems both for existing portfolios as well as start-up. This diverse background has contributed to proficiency in the areas of documentation, compliance, loan participations, credit analysis, cash flow, asset-based financing, policies and procedures and portfolio management. Janice has a certificate from RMA Lending Academy and a bachelor’s degree graduating Cum Laude from Seattle Pacific University.

Alexis Tomsen

Alexis is responsible for pre-audit preparation, including communicating with the clients, preparing pull lists, and initializing IT set-up. Additionally, she performs the Sarbanes-Oxley audits and participates in other specialized projects for the firm.

Alexis has over 20 years of commercial bank experience primarily focused on community banks in the Bay Area. She has extensive knowledge in credit risk assessments, lending guidelines, compliance, underwriting, entity structuring, loan documentation and collateral perfection, including title insurance and endorsement requirements. Alexis has a Bachelor of Science degree in Business with a major in accounting, graduating Summa Cum Laude from Capella University. She also holds certifications from American Bankers Association Compliance School and California Bankers Association Commercial Lending School.

Susan Drack

Susan serves in a lead role, overseeing various credit reviews, conducting stress test and CRE concentration reviews as well as supervising various special projects.

Susan Drack has over 47 years of banking experience at major, regional and community banks in the Western US. Most recently she oversaw commercial real estate lending for a major bank in SoCal/NV. Her lending expertise includes commercial, SBA, consumer, dealer and CRE lending (development, construction and permanent), having been in both production and workout. Susan has a Bachelor of Science in Business with a concentration in Finance from California State University, Sacramento, an MBA in Finance/Real Estate from Golden Gate University and is a 2017 graduate of Pacific Coast Banking School.

Irene Matyas

Irene serves in a lead role assisting with various credit reviews and special projects.

Irene has spent 20 years dedicated to Commercial Lending with a major national bank for diverse industries and markets throughout Northern California, Southern California, and Oregon. Irene began her banking career originating commercial loans in Los Angeles, and quickly moved to leadership roles managing other lenders and ultimately, multiple lending teams in Oregon and Northern California. Her experience includes managing large, complex loan portfolios composed of commercial and investor real estate, C&I, ABL, SBA (7(a) and 504 loans), construction, equipment, and problem loans. Irene received an Honors Bachelor’s Degree from Canada’s York University and graduated from Pacific Coast Banking School where she earned a special citation.

John Rockwell

John Rockwell has over forty years of commercial bank experience for both National, Regional and Community banks. Primary emphasis on credit and risk management. Most recently, John served as Chief Credit Officer and Sr. Credit Administrator for two successful independent community banks in the SF Bay Area prior to their sale/merger. Specific areas of expertise include Commercial, C&I and Asset Based lending, Real Estate lending (development, construction, and permanent finance), SBA 7a and 504 lending as well as Special Assets/Problem loan resolution.

Carol Corsetti

Carol Corsetti has over 50 years of banking experience with regional and community banks throughout California, serving in a variety of roles in both operations and lending. Most recently, Carol served as Senior Lending Officer as well as Chief Credit Officer for three community banks. She has held the roles of Credit Analyst, Portfolio Manager, Credit Administrator, and Escrow Officer and has supervised loan underwriting activities, including loan processing, loan documentation and servicing functions. Areas of expertise include commercial real estate lending (development, construction, and permanent loan financing), bank adherence to USPAP and FIRREA, as well as problem loan resolution.

Cathleen Stark

Cathleen Stark has over 35 years of banking experience at national, regional, and community banks in California. Her lending experience includes all levels of relationship management, risk management, credit underwriting and credit exams. Specific areas of expertise include Commercial Real Estate lending, Commercial and Industrial general lending, High Technology lending and SBA 7(a) financing. She has also held leadership roles in community banking as a Senior Vice President Area Manager and as an investor real estate specialist. Cathy earned her Bachelor of Arts degree in Economics and minor in Accounting from Stanford University.

Elaine Pasch

Elaine has over 35 years of commercial banking experience, with the last 30 plus years focused on commercial lending with regional and community banks in Northern California. She has been a Note Department Supervisor, Commercial Loan Underwriter, Credit Services Group Manager, Credit Administration Officer, Portfolio Manager, and Relationship Manager. Her lending experience includes originating and managing C&I and Asset Based loans, Commercial Real Estate, Single Family & Multi-Family Investment properties, in addition to RE flipper projects. Credit administration experience includes monitoring Bank’s Watch and Classified graded loans, prepare management reports, and assist with quarterly ALLL reports.

Giancarl Johnson

Giancarl has 15 years of banking experience covering many different banking roles including sales, relationship management, and credit. His most recent role was providing underwriting support to Morgan Stanley Private Bank clients where he was a senior underwriter on the Ultra High Net Worth team for 4 years. Before that, he spent time as a commercial underwriter with several community banks. His specialty is untangling complex financial arrangements for high net worth and commercial real estate borrowers to determine simplified cash flow analysis. His prior credit experience includes C&I, commercial real estate, residential mortgage, SBA, non profit, and participation lending. In 2024, he was assigned to provide underwriting support to the Morgan Stanley commercial real estate group for portfolio stress testing. He holds an undergraduate degree in Economics from UC Berkeley, and graduate degrees in economics, accounting, and an MBA. He is also an active CFA Charterholder. In his spare time, he has taught both graduate and undergraduate courses in finance and accounting at private universities. He has also designed coursework for training new bank board members which was approved by the FDIC for a new bank charter.

Glenn Rilinger

Glenn has over 30 years experience in commercial lending for community and regional banks in Northern California. The majority of his experience has been concentrated in all aspects of SBA 7a, SBA 504, and USDA B&I including origination, underwriting, construction, servicing, and secondary market sales. For over 18 years Glenn held the position of Government Guaranteed Lending Manager at a community bank that was active in both SBA and USDA guaranteed programs. He has a Bachelor of Science degree in Business Administration with emphasis in Finance & Accounting from California State University, Chico, and is also a graduate of Pacific Coast Banking School in Seattle, Washington.

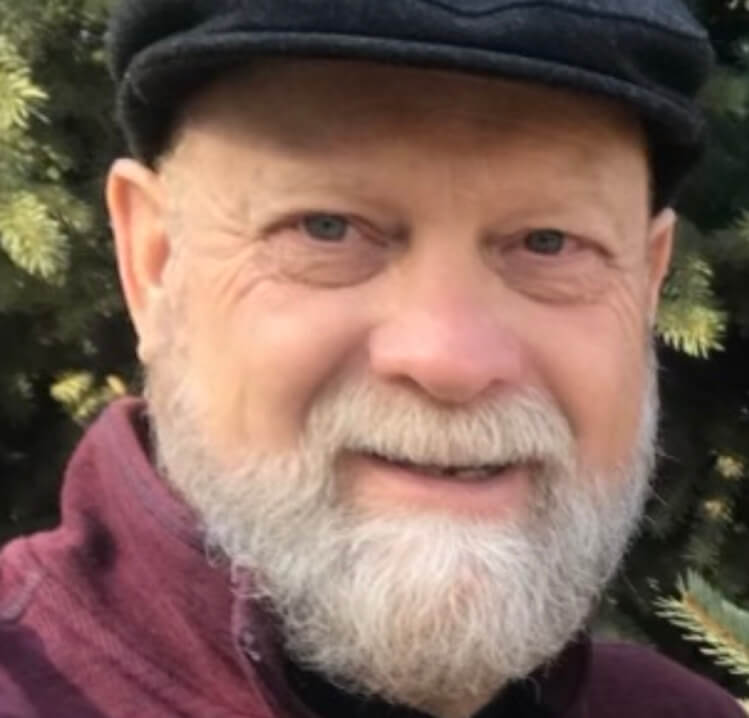

Jerry Carlson

After completing his MBA at Pepperdine, Jerry assumed the position of Senior Loan Officer at Goleta National Bank doing credit underwriting and various administrative tasks. Later he successfully negotiated and settled sizable and complex work-out credits during his four years at Ventura County National Bank. At Glendale Federal, Jerry managed on-site, state-wide loan reviews of separate units including real estate investment, agribusiness, commercial lending, asset-based credit facilities, and SBA lending. At People’s Bank, LA, he managed the department responsible for servicing, documentation, quality control, collections, and special projects. Jerry has several years’ experience as an executive consultant and acting senior credit officer for independent banks and holds an LLB degree.

Jim Fehring

Jim Fehring has over 22 years of banking experience at national, regional, and community banks in California. His lending experience includes all levels of commercial underwriting, documentation, business development, relationship management, risk management, and workout. Specific areas of expertise include Commercial Real Estate lending (development, construction, and permanent including SBA 504), C&I and Asset-based lending, Vineyard lending (development and farming lines), and Winery lending (lines and loans). He has represented his portfolios to Bank Boards for ongoing risk reporting and management. Jim earned his Bachelor of Arts degree in English from Stanford University, with additional study there in accounting and economics, and he has completed many banking industry ongoing education courses.

Patrick Swartz

Patrick has extensive community banking experience specializing in C&I loans, SBA loans, and commercial real estate and development loans. He has been in banking and lending for over 35 years and was an SVP/Acting Senior Lender with a small community bank in Northern California and served as a VP/Commercial Real Estate Lender as well as an AVP/Branch Manager overseeing SBA 7(a) and 504 lending. He also worked as a Supervisory Loan Officer with the SBA Disaster Assistance Division. He has experience in debt-restructuring and loan work-outs and holds a B.S. in Business Administration with a concentration in Accounting from San Jose State University and a California Community College Teaching Credential in Accounting, Banking, and Finance. He has served on various boards of non-profits. Patrick is a Certified Management Accountant and is a member of the Institute of Certified Management Accountants. He also obtained an Accreditation in Business Valuation. In addition to providing SBA and commercial loan review and due diligence for banks and financial institutions, Patrick provides accounting and financial consulting services and has been the Controller/CFO for several small family-owned businesses and a large non-profit health care organization.

Steven Martin

Steven has over 32 years of commercial banking experience with several regional and community banks in Central California. He has been a commercial underwriter, loan portfolio manager, commercial loan officer/relationship manager, credit administrator, special assets officer, construction loan manager, underwriting trainer, regional manager, regional president, loan administrator, and agricultural appraiser. Areas of expertise cover all areas of commercial lending including Agriculture, C&I loans and lines, Asset Based Lending, Construction, Real Estate, and Problem Loan workouts. He has a bachelor’s degree in Plant Science with emphasis in Plant Protection and Pest Management from UC Davis, a bachelor’s degree in Accounting from Golden Gate University, MBA in Finance from Golden Gate University and is a graduate of the Pacific Coast Banking School.

Jim Rakos

Jim Rakos has over thirty years of banking experience for national, regional, and community banks in Northern California having served in a variety of roles in both loan origination and underwriting. Specific areas of expertise include Commercial Real Estate lending, Commercial and Industrial general lending and Construction lending. Most recently, he served as VP Relationship Manager Investor Real Estate Specialist at a major national bank. Jim earned his Bachelor of Arts degree in Economics from the University of California Santa Cruz and a Master of Science degree in Accounting from San Jose State University.

Rebecca MacLeod

Rebecca has over 45 years of banking experience, with most of her career focused on commercial lending with regional and community banks in Northern California. Prior to becoming an Independent Banking Consultant, she was Regional Credit Administrator covering Northern California and the North Coast. Her lending experience includes originating and managing C&I and Asset Based loans, Commercial Real Estate, Single Family and Multi-Family Investment properties, in addition to Commercial Real Estate Construction and problem loan resolution.

Paula Kinnison

Paula Kinnison has over 32 years of banking experience having served as Senior Vice President at a major national bank for over 31 years. Her lending expertise includes commercial banking, investor real estate lending, and treasury management throughout most states in the US. She has overseen complex underwriting, credit monitoring, risk examinations and relationship management. Paula has been involved in term lending, complex portfolio management, loan workouts, construction lending and CMBS monitoring and lending. Paula has a Bachelor of Arts degree from Stanford University in Public Policy and an MBA from UCLA in Finance and Real Estate. She was twice awarded the top national award for being the best banker in her division.

Cameron Holder

Cameron Holder has over 12 years of experience in commercial banking with both national and community banks. Areas of expertise include commercial & industrial, owner-occupied & investor real estate, hospitality, construction, healthcare, agricultural, and oil & gas lending. He is an experienced Credit Administrator, Underwriter, and Manager successful in developing and training teams, providing leadership and guidance on underwriting, policies, and procedures, while creating new processes to improve efficiency and risk management. He holds a bachelor’s degree in business finance from California State University, Bakersfield.

Roselyn F. Allyn

With over 35 years of experience in commercial lending and credit administration, Roselyn Allyn is a key asset in the banking sector. Her expertise in credit risk assessment, special assets management, and lending compliance enables her to navigate complex financial environments effectively.

She has held leadership positions in several San Francisco Bay Area banks, including Senior Credit Officer, Risk Manager, Special Assets Administrator, and Credit Review Officer. In these roles, she successfully managed large and complex middle-market loan portfolios.

Roselyn graduated Cum Laude with a degree in International Studies from Maryknoll College and completed the Graduate School of Banking at the University of Colorado.

Mark Monasch

Mark Monasch has over 25 years of banking experience at community, regional and national banks in California. His lending experience includes all levels of relationship management, risk management, credit underwriting and credit exams. His specific areas of expertise include Commercial Real Estate lending, Construction Lending, and C&I general lending. In between banking stints, Mark spent 10 years as the owner and operator of a retail store and an athletic team supply business. Mark graduated Cum Laud with a Bachelor of Science degree in Business Administration with an emphasis on Entrepreneurship from the University of Southern California.

Carol Garrett

Carol Garrett has banking and financial services expertise and is currently serving as an Independent Credit Review Consultant for community and regional banks. Most recently Managing Director at U.S. Bank/Union Bank in Northern California, she oversaw commercial banking loan portfolios for companies generating up to $2 billion in revenues and managed underwriting teams. Her expertise spans commercial real estate, C&I lending, acquisitions, and syndications, with a proven track record of satisfactory regulatory reviews and recognition as a subject matter expert in credit policies. Carol holds an MBA from Saint Mary’s College and a BA in Economics from UC Davis.

Kent McKay

Kent has over 35 years of professional experience, including more than 11 years as a National Bank Examiner with the OCC and six years as a Senior Manager at a Big Four accounting and consulting firm, where he conducted credit reviews and provided credit process consulting. In addition, he has over 15 years of experience leading internal loan and asset quality reviews for multiple financial institutions. His areas of expertise include, but are not limited to, Oil & Gas Lending, Agricultural Lending, Special Asset Management, Entertainment Lending, and Leveraged Lending.